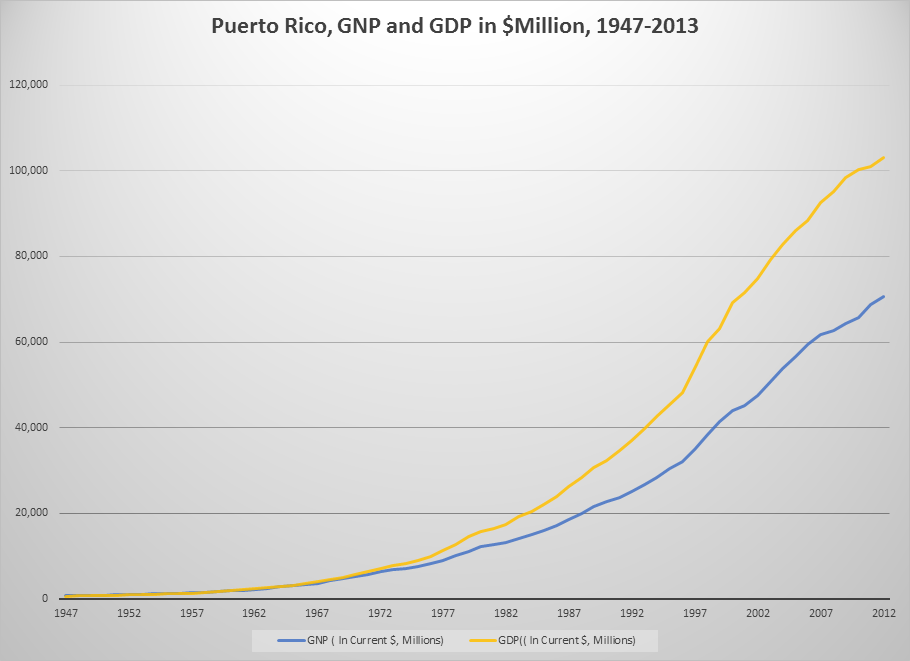

Background to Puerto Rico’s DebtPresentation to SEIU Local 32BJ May 14, 2016– Vamos 4 Puerto RicoSEIU- Vamos 4 Puerto Rico Teach-In César J. Ayala (UCLA) Too see this page as a Powerpoint Presentation Click Here Para ver esta página en formato Powerpoint en español haga clic aquí The Phenomenal Drain of ProfitBeginning in the 1970s, Puerto Rico’s economy began to suffer a drain of profits, to the point where the measure of total income produced in the island, the Gross Domestic Product, began to separate dramatically from the measure of income that residents own, the Gross National Product or GNP.

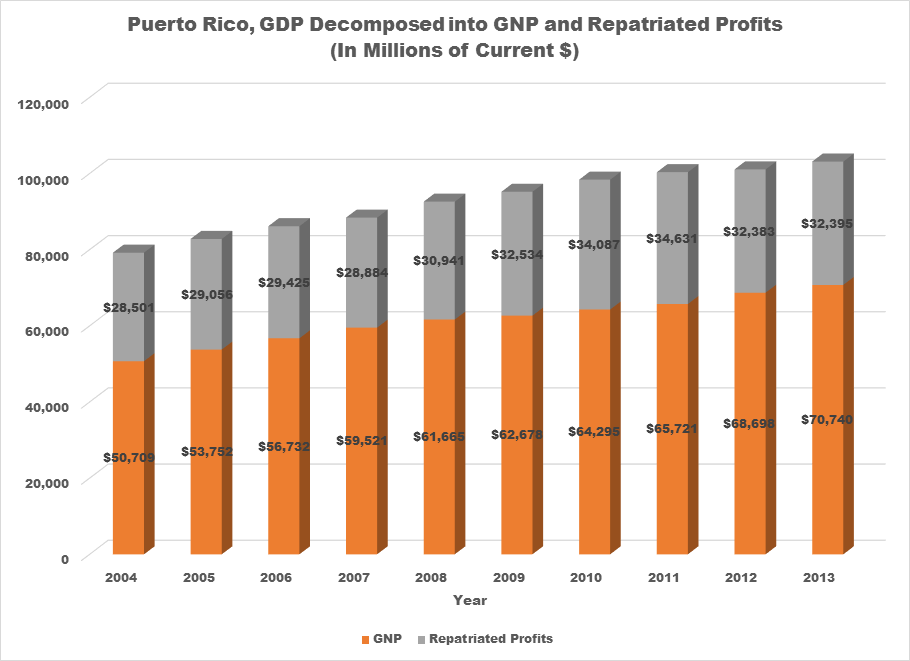

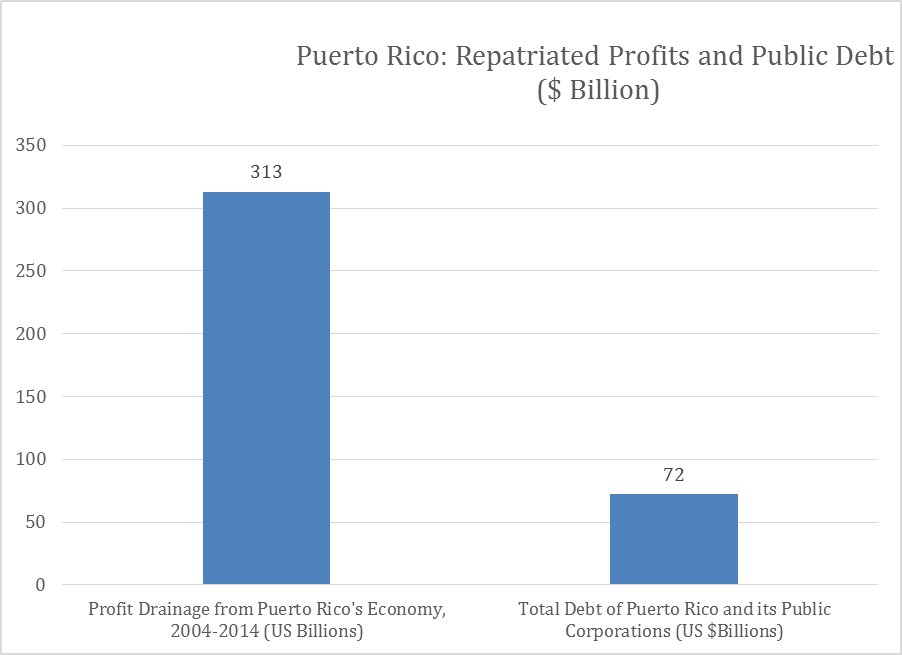

Source: GNP and GDP data is from Puerto Rico Planning Board. This divergence owes itself to the extraordinary volume of profits that leave Puerto Rico into the hands of the foreign investors that control its economy. A third of the income that is generated in Puerto Rico leaves the country each year in the form of repatriated profits. In other words, the gross National Product of Puerto Rico, or the income that belongs to the residents of the island, is 67% of the total income generated there; the other third is taken away by U.S. corporations. This is a phenomenal drain of resources in an economy controlled primarily by American multinational corporations. In the graph below, the columns represent the Gross Domestic Product of Puerto Rico, broken down into the part belonging to the island’s residents (GNP) and the part of the income that U.S. investors take home in the form of repatriated profits. Puerto Rico’s debt is currently valued at 70 billion dollars; U.S. corporations repatriated 313 billion dollars between 2004 and 2013. To put this drain in perspective, repatriated profits in the last decade alone are enough to pay the entire debt of Puerto Rico’s government and its public corporations four times over!

This problem, and the underlying dependency which underlies Puerto Rico’s economy, had already been pointed to in the 1970s. Faced with a looming fiscal crisis, in 1974 the Hernandez Colon administration appointed a commission led by well-known economist James Tobin to prepare a report on Puerto Rico's finances. Tobin's Report to the Governor included reflections on long-term trends and recognized that "poverty and unemployment are still immediate problems for a large portion of Puerto Rico's population." It admitted that "dependence" was an appropriate description of the Puerto Rican economy: half of the "tangible reproducible assets" located in Puerto Rico were "externally owned."[1] This meant that a considerable portion of the income generated was not reinvested on the island. Furthermore, the report warned that Puerto Rico's ability to attract U.S. capital was being eroded. In the past, U.S. capital had been attracted by low wages, unrestricted access to the U.S. market, and the security afforded by the political link with the United States. But other areas could offer lower wages, many were gaining access to the U.S. market, and not all were insecure or unstable. The report concluded that Puerto Rico should formulate an economic program less reliant on U.S. capital. Yet, the insular government responded to the crisis by deepening its tax exemption policy, confirming its commitment to U.S. direct investments as the agent of Puerto Rico's development.[2] And the prediction about future consequences was clear. In 1975, Tobin's Report to the Governor had pointed out that the outflow of profits resulting from external control of much of the Puerto Rican economy was statistically reflected in the widening gap between the gross domestic product and the gross national product, that is to say, between the measure of the island's income-generating activity and that of the income received by its residents.[3] The less the expansion of the GDP was reflected in the growth of the GNP, the less the island's economic expansion would translate into the welfare of its inhabitants. The report predicted that "growing dependence on external resources" and the shift to capital-intensive investments, which spent relatively less in wages per unit of capital and extracted considerable profits, would tend to widen this gap.[4]

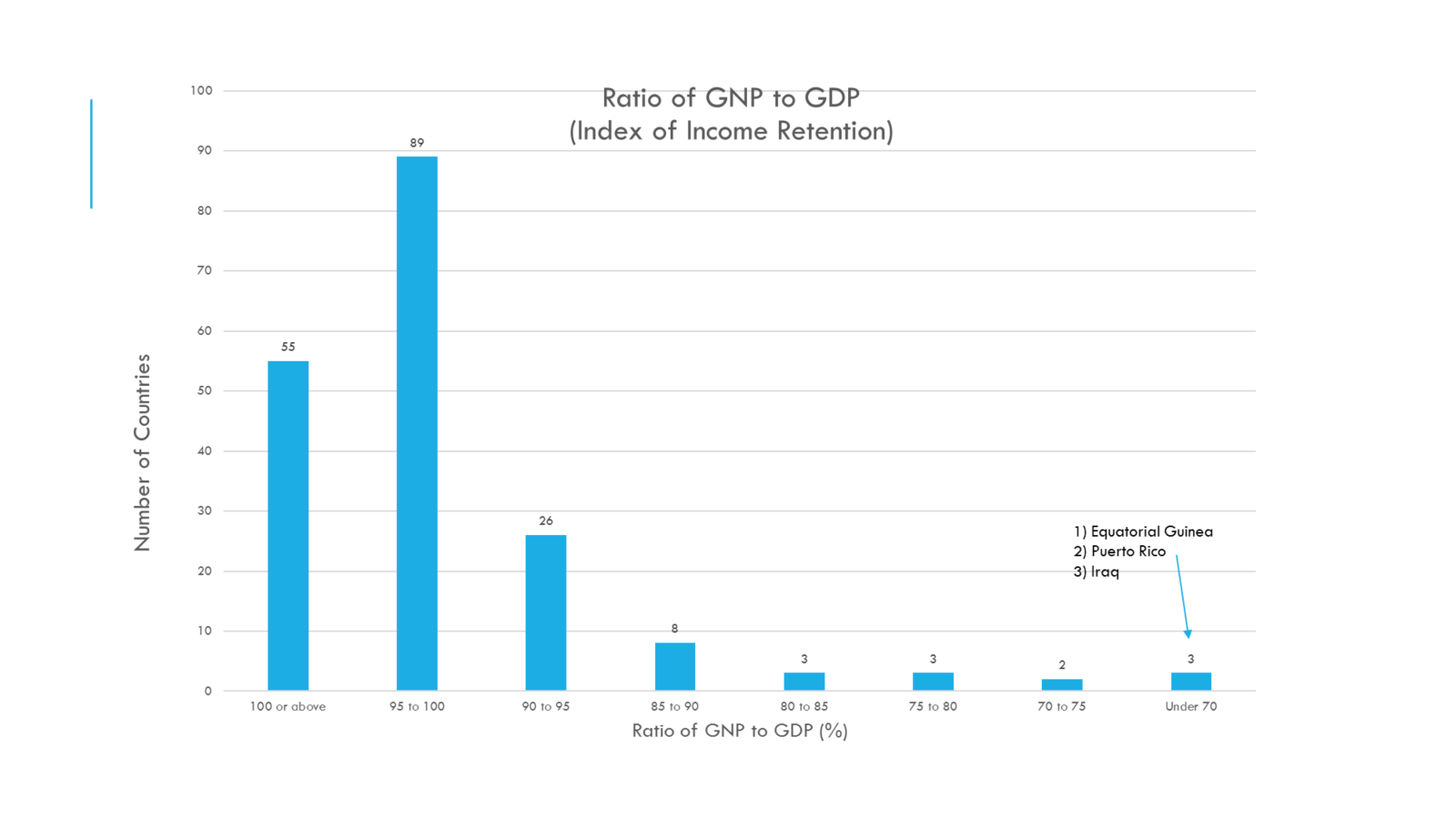

Payments to absentee capital constitute the elephant in the room that is never mentioned in discussions of Puerto Rico’s debt problems. If we take the last decade, the profits earned in two of the last ten years, or an equivalent of 20% in taxes on the total profits generated during that decade, would be enough to leave Puerto Rico free of debt. An Extraordinary CaseOne might think that the case of Puerto Rico is normal with respect to Foreign Direct Investment and the resulting proportion of the income it produces that escapes into the hands of foreign investors. However, this is not the case. Puerto Rico’s situation is exceptional in terms of repatriation of profits and the drain it creates on the local economy. The following table represents GDP and GNP in a number of selected countries. In the worst of these cases, Ireland, extracted profits are not even half of those of Puerto Rico (15 % of the GDP compared to 33% in Puerto Rico).

It is time to ask, then, whether Puerto Rico can recover from its debt crisis without confronting the elephant in the room (profit repatriation), that is, without demanding contributions from the corporations that make so much money in the island? In case anyone doubts that the problem of absentee capital in Puerto Rico is extreme, here is a list of 189 countries with the ratio of GNP/GDP. Puerto Rico ranks 188 of 189! The mean GNP/GDP ratio is 97.32, the Standard Deviation is 8.62, which means that Puerto Rico is 3.5 Standard Deviations below the mean! Puerto Rico is truly a statistical outlier when it comes to the percentage of its GDP that drains out of its economy due to profit repatriation by absentee capital. (See GNP/GDP Ratio for All Countries) Exceptional Case of Profit DrainPuerto Rico is one of only 3 “countries” in the world that lose more than 30% of the income generated within their territories. The other two are Equatorial Guinea and Iraq.

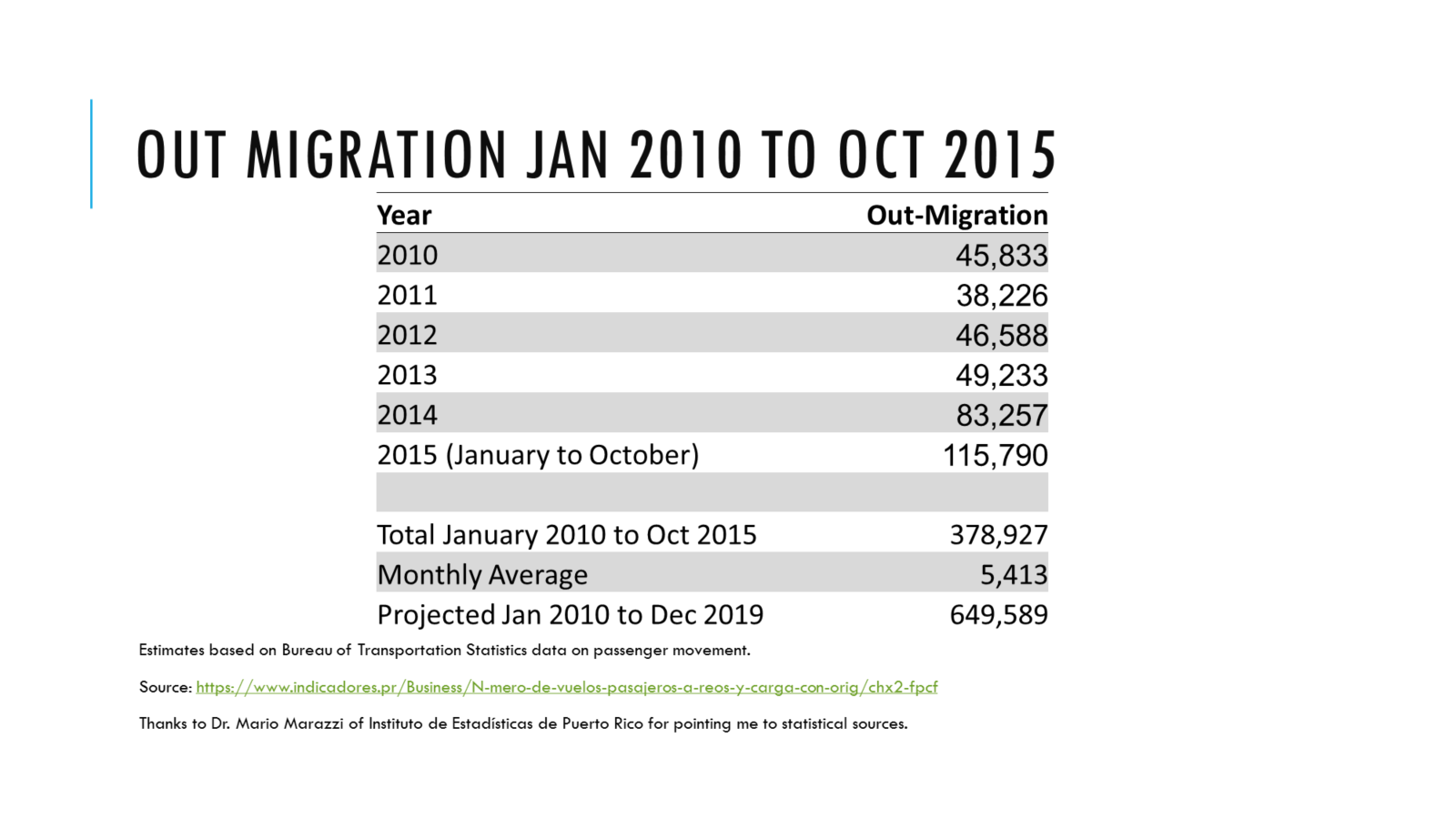

Currentt Proposals are based on regressive taxationCurrent proposals are all based on paying the vulture funds by squeezing working people through REGRESSIVE TAXATION (especially through sales taxes, currently above 11%!!!). These measures and proposals cover only the income retained in Puerto Rico but leave untouched the third of the GDP that leaves the island as repatriated profits! The crisis has been affecting the population for over a decade • 88,000 government jobs lost • 53,000 manufacturing jobs lost • 52,000 construction jobs lost • Unemployment Rose from 11% to 13% even as thousands of workers left the island! • Approximately 263,000 people left between 2010 and 2014 • this surpasses the figures for the highest levels of out-migration during the “Great Migration” of the 1950s (237,000 between 1950 and 1954)

· The financial crisis, and the issue of debt moratorium for Puerto Rico, is part of a much larger social and economic catastrophe that has been hurting Puerto Rico for over a decade, since the elimination of Section 936 of the Internal revenue Code, in 1996-2006. · During the period 2006-2015, the outflow of profits from the island has been sustained, but jobs and social conditions have deteriorated for the overwhelming majority of the population. · Massive emigration is the primary indicator of the magnitude of the crisis.

NOTES [1] James Tobin, et al., Report to the Governor: Committee to Study Puerto Rico's Finances (n.p., 1975), 6, 62. [2] César J. Ayala and Rafael Bernabe, Puerto Rico in the American Century: A History since 1898 (Chapel Hill: University of North Carolina Press, 2007), 268. [3] Tobin, Report to the Governor, 15. [4] Ayala and Bernabe, Puerto Rico in the American Century, 270. LINKS |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||